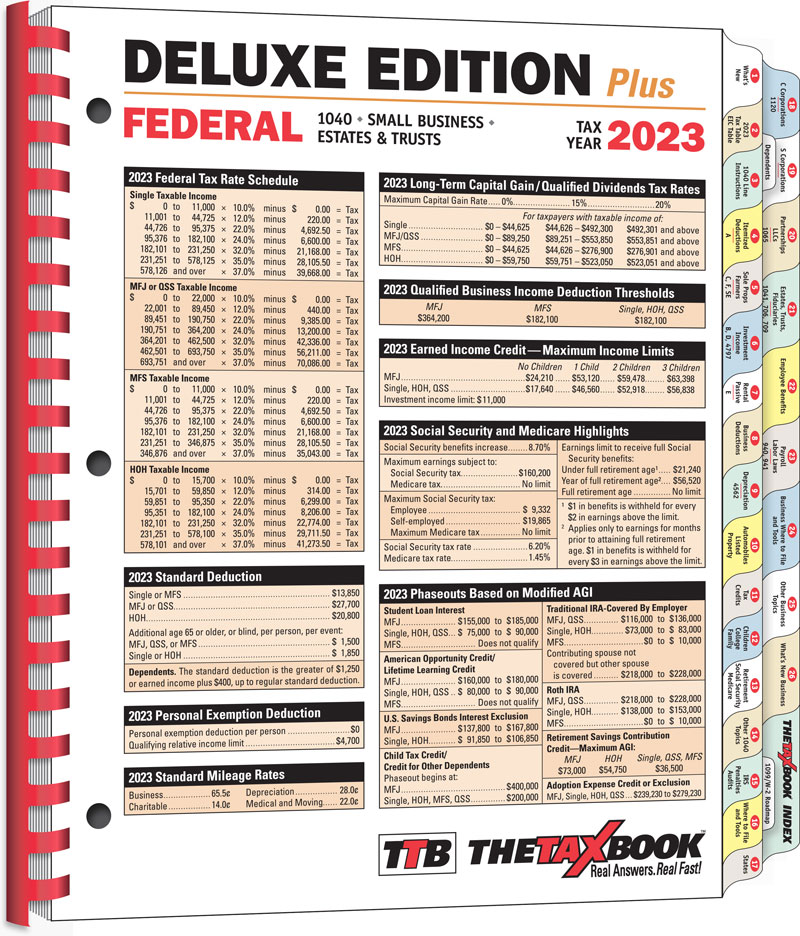

Refunds Today is proud to offer the TaxBook, an invaluable resource for any tax office. These 500+ page spiral bound books give you the tax answers you need right at your fingertips. Designed as a quick reference guide, these books provide plain-English guidance for any tax scenario.

Choose from either the 1040 Edition which focuses on 1040 Individual returns or the Deluxe Edition which adds Small Business content including C & S Corporations, Trusts, Partnerships, LLCs, Estates, etc.

You'll benefit from...

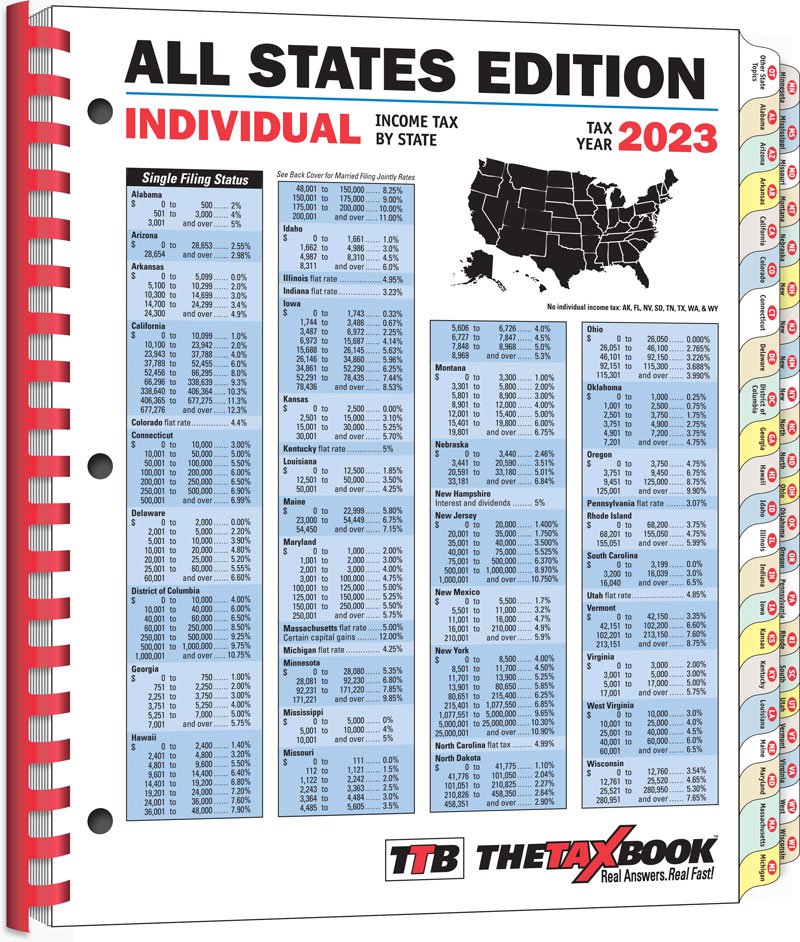

TheTaxBook All States edition is the perfect book for tax preparers that prepare out-of-state returns. This book contains fast answers to state specific individual tax questions.

Content includes individual tax rates, filing requirements, additions, subtractions, adjustments, exemptions, credits, and more for each state.

With TheTaxBook™ WebLibrary you can easily access relevant tax information without having to go far. Having the most up-to-date tax information at your fingertips is critical during tax season. Find information fast, with well-written and easy-to-understand explanations and examples.

Save time so you can focus on getting your clients' taxes done quicker than ever!

WebLibrary features:

The U.S. Master Tax Guide was meticulously researched to cover today's federal tax law and was expertly-written to help identify tax planning opportunities, ensure accuracy when filing taxes, maximize your knowledge of all of the latest tax law developments , and serve as a quick reference guide when providing tax services to your business or clients.

The U.S. Master Tax Guide includes:

The U.S. Master Tax Guide is conveniently cross-referenced to the Internal Revenue Code, Income Tax Regulations, and certain other important tax law sources for further research. Additionally, references are included to expanded explanations on Wolters Kluwer's award-winning research service, CCH® AnswerConnect. This reliable reference is a must for anyone involved with federal taxation.

This time-saving tax guide acts as a quick reference for the taxes levied by the state of California, including personal income, corporate income, sales and use, and property taxes. Readers will receive the most up-to-date information on: